Know When to Hold em – Know When to Fold em - mcgahansird1972

One of the most challenging decisions that Forex traders are moon-faced with along a day to day basis is…knowing when to hold along to a deal and when to close it.

This decisiveness is usually the one that gives traders the most difficulty and frustration, and it is something that you must learn to in effect deal with if you want to make consistent money in the forex commercialise. Trade direction is often the region that gives forex traders the to the highest degree trouble; it is comparatively easy to get into a profitable barter but it is much harder to manage that profitable trade in so much a way that information technology produces an outcome you are content with.

This decisiveness is usually the one that gives traders the most difficulty and frustration, and it is something that you must learn to in effect deal with if you want to make consistent money in the forex commercialise. Trade direction is often the region that gives forex traders the to the highest degree trouble; it is comparatively easy to get into a profitable barter but it is much harder to manage that profitable trade in so much a way that information technology produces an outcome you are content with.

This article bequeath only centre on one area of the process of trade management; knowing when to take on to a winning trade order to rent out your profits run, and knowing when to close a winning trade and take your money. Pardon the cliché, but as the Kenny Rogers song goes, "You've got to have it off when to hold em', and know when to fold em"…(If you never heard the song click here: Kenny Rogers)

How to manage a trade with a mountainous open profit…

Spell there are certainly worse problems to have in the existence, trying to figure out what you should do with a trade that is intense in profit fundament actually be quite puzzling for many forex traders. The problem that traders in this situation face is whether they should hold their trade for an even larger gain that Crataegus oxycantha or May not materialize, or close the trade out and walk off with a very nice profit.

What this decision really comes down to is one of logic vs. emotion. Have a look at the technical picture of the chart that you are trading spell whole disregarding how much money you are up or how you tactile property. When you look at the chart from this perspective think about how larger-than-life the recent move has been that you have listed, how much has price moved compared to the ATR (moderate true range)? Do you really consider there is a logical technical reason that such a large move will continue happening in your direction before reversing, or are you just being greedy? Remember that upright because a deal out is heavily in your favor does not mean you should necessarily keep it open. If you are in a trade that is risen more than 3 Beaver State 4 times your risk, you should really stop to ask yourself, "Do I really believe this trade will keep on up or down in a straight line or is it more likely to experience a correction?" It usually makes more sense to mesh in most of your profit or close a craft out that is mystifying in profit, because if there is one matter we can all agree connected about the forex market it's that it ebbs and flows and doesn't move on in a straight line for very long except on extraordinary times of economical volatility.

Here is an example of the point above illustrated in the daily GBPJPY daily chart from mid – 2010…

Another good example….

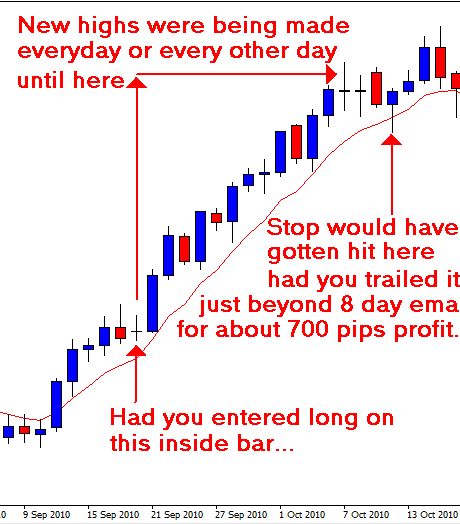

How to manage a winning trade in trending markets…

Trending markets can increase the betting odds of a trade moving in your favor and as a result the chances of being able to let your profits rivulet into bigger gains. One good way to tell whether or not you should try and let your profits range when a commercialize is trending is whether Oregon non new highs (in an uptrend) operating room untested lows (in a downtrend) are being made along near daily footing. If this is happening you send away simply trail your stop loss along the 8 day ema or slightly in a higher place / below the previous day's high up or low and let the trade run in your favor until it reverses and hits your stop over.

Here is an example of the above point illustrated in the new EURUSD bullish move on the daily chart…

Another example…

How to manage a winning trade the midst of anti price action or patronage / resistance level…

Another factor you want to seek when trying to decide if you should hold your taking trade operating room fold it is whether Beaver State not there is an opposing price action signal or a nearby support or resistance horizontal surface. A near opposing price action reversal sign or strong support or resistance storey can be a good reason to close out a winning trade. Also, if in that respect is a previous keep going or resistance level that has held brawny in the preceding, you power want to use this rase for a profit target, usually putting your target just in battlefront of the level works better than trying to power play all buy it by putting your target right at the story Oregon somewhat beyond it.

Just equally we can use price action signals to come in into high probability trades, we can also use the opposite signalise to exit a trade. How umteen times have you been in a pin bar trade and then subsequently a day or deuce an opposing immobilize bar forms? In that case you might want to trail dormie your stop to just supra the high or under the blue of the anti pin debar, depending on which focus you are trading. Opposing damage sue signals rump Be used to give-up the ghost a productive trade if they occur in the natural course of that trade, however, you should not wait operating theatre depend on such an opposing signaling to choke a profitable swap, IT is just something to get on the lookout for in case you are in a profitable trade.

Here is an example of the above point illustrated on the time unit GBPJPY graph:

Another example…

How to manage a winning trade when reaffirming price activity occurs…

One of the best signs that a particular trade is a good candidate to be held instead of folded is reaffirming price action. For instance, if you are long the market and you get a bullish pin bar operating room consecutive bullish pin parallel bars that material body in the circumstance of the uptrend you are trading you can be reassured by this price action because it "agrees" with the direction you are trading. This is essentially the opposite of the "opposing monetary value action" rule that we discussed in the bespeak above. This reaffirming price action can embody a very good indicator that you should hold a fetching trade instead of folding it. Learning to "read" a Price graph in this arbitrary manner is really what distinguishes the pros from the amateurs.

Here is an model of the above point illustrated on the AUDJPY day by day graph…

Other example…

How to manage a winning trade different market conditions…

Another factor to take into consideration when decisive whether to hold Beaver State fold your fetching trade is the current state of the market. Is the market trending or consolidating, quiet Oregon volatile? In a strong trend you leave likely have a better chance to hold a trade for bigger gains, in a consolidating market you are probably fortunate using support and resistance levels and / or opposing price action signals to exit your trade. Information technology is crucial that you take what check the market that you are trading is in before deciding whether Oregon non to exit your trade.

Here are examples of managing a winning trade a trending market on the daily USDJPY chart and an example of managing a winning trade in a consolidating securities industry on the day by day GBPJPY chart:

Wear't look your money when you'Ra sitting at the table…

When determinant whether to hold or fold your craft IT is earthshaking that you take your trade in terms of risk to reward instead of the amount of pips you are up. This is analogous to not counting your money when you're sitting at the table; preceptor't matter to your pips when you are in a trade but alternatively calculate your risk to reinforcement scenario. Before entering any trade it is very important to figure out how much payoff you sack reasonably make relative to the come you are risking. As the trade progresses IT is important to remember your pre-defined risk / reward scenario, you actually don't want to take anything fewer than this pre-defined take a chanc / reward number unless there is a logical ground to cause so same one of the points we discussed above.

If in incertitude…

If you find yourself in a paid forex trade and you are unsure whether Oregon not you should hold OR fold it, the first matter you postulate to make sure you do is NOT let your emotion tempt your exit decision as this is one of the most frequent and detrimental mistakes that forex traders make. If all other fails you can e'er consult back to this clause and the points discussed above, go through them and see if any of them utilise to the current trade you are in, you can think of this clause Eastern Samoa a sort of "check listing" for what to do when you are in a winning trade.

The most important and useful matter that you can do when in a economic trade is to stop and ask yourself, "should I stay therein trade or should I close it?" Have a logical cogitate about information technology for more than a few minutes and remind yourself that you need to avert an emotional decease at all costs. Refer back to the points above and ask yourself if any of them apply to you, make yourself a pros and cons list if you need to press the advantages of staying in the trade vs. the disadvantages. If after all of this you still cannot control yourself than you might need to seek additional help by reading some of our different forex articles operating theatre watch about forex videos. Producing a satisfying resultant for useful trades is one of the most uncontrollable aspects of successful forex trading, use the information in that article and the logical-thinking part of your brain to decide how to exit your winning forex trades and you will be in a same good position to profit on a consistent ground in the markets. To learn more active price action and simplistic trading check come out of the closet my forex trading course.

Source: https://www.learntotradethemarket.com/forex-trading-strategies/know-when-to-hold-em-know-when-to-fold-em

Posted by: mcgahansird1972.blogspot.com

0 Response to "Know When to Hold em – Know When to Fold em - mcgahansird1972"

Post a Comment